Begin to look after your financial health

One of the reasons why we created gibobs was because we wanted to make the finantial system easier to understand and accessible for everyone. Since young, we are teached to gain money but nobody teaches us to manage it, right? That´s why, we have developed a number of financial services that don´t make a cost for you but allow you to know wich is the real state of your finances and wich choices to take in order to improve your finantial health.

Register to begin

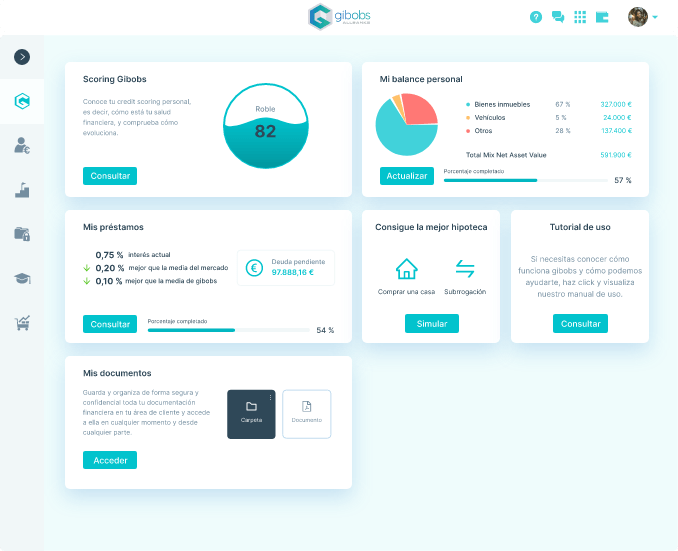

My personal balance

To know the real status of your finances, you must ascertain your personal balance, that is, your wealth. And by wealth, we do not only refer to your income and expenses, but also to your assets (that is, the value of your material possessions, such as your home or car) and your liabilities (your pending debts, such as loans or mortgages).

With this information, you can find out your wealth in real time and see its performance. And, moreover, we will show you a series of ratios that will help you to understand your financial position in detail.

Find out now

My loans

If you have various financial products arranged with different banks, this service will be perfect for you. And if you do not, it will be perfect too! Thanks to “My loans”, you will see your loans and mortgages at a glance, that is, how much you have paid and how much you have left to pay.

What is more, you can compare your current interest rates with the market average and thereby know in which cases you can obtain better conditions to stop paying more for your financial products.

Find out now

gibobs scoring

We bet you have heard of the term “financial health” more than once in your life. Well, your personal scoring is something similar to a medical check-up, which indicates the state of your finances, how they have evolved over the years and the credit risk profile that you would have for a bank or, what comes to the same thing, your probabilities of being granted a mortgage, a loan or any other financial product.

Find out now

My documents

We take data protection very seriously and, thus, in your client area, you can store all your financial information in a secure confidential manner, which you can access at any time anywhere. Your data will be encrypted and you can verify the history of each file and know when it was consulted or resent.

Furthermore, this function will help you to organise your documentation by category and you will always have it at hand in a single place.

Find out now

Financial products

Do you want to buy a house and are you looking for a mortgage? Whatever you need, our team of advisers will not stop until you obtain the best market conditions and it will help you to take the decisions that look after your financial health.

And remember: you will have the control and you will decide which offer you want to take out from those we present to you. Moreover, you can monitor the transaction’s status at all times with the help of your adviser.