How does gibobs work?

Our business model is based on transparency and, that´s why, we want to explain you how gibobs works in a very clear way in order to help you to resolve all your doubts.

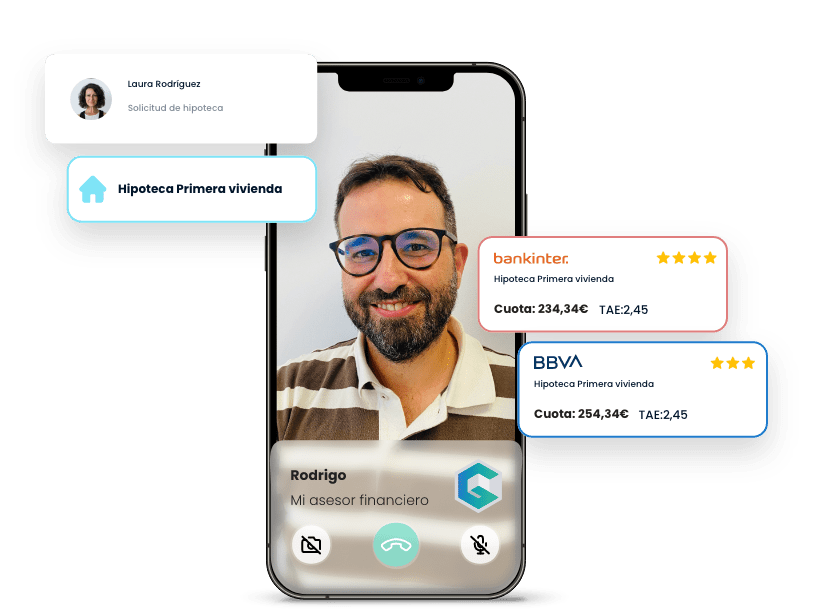

At gibobs, you have available a number of free of charge services that help you to look after your financial health. But moreover, we dedicate ourselves to finding the financial products required by each customer in line with their personal circumstances, especially mortgages.

Begin to use gibobs